Characteristics of Tokaido REIT

Tokaido REIT invests in the Tokaido region,

which connects Japan’s eastern and western hubs

and boasts the world’s third-largest economy

Tokaido is an arterial road connecting Osaka and Kyoto, which have been economic hubs of Japan dating back to centuries ago, and Tokyo (previously known as Edo), which became another economic hub of Japan from the Edo Period. Due largely to the Tokaido region’s (Note 1) unique location on the Japanese archipelago, it has a long history of craftwork and manufacturing that underpinned many livelihoods, logistics, human transport, tourism, and hospitality. This region continues to serve as an economic powerhouse of the nation.

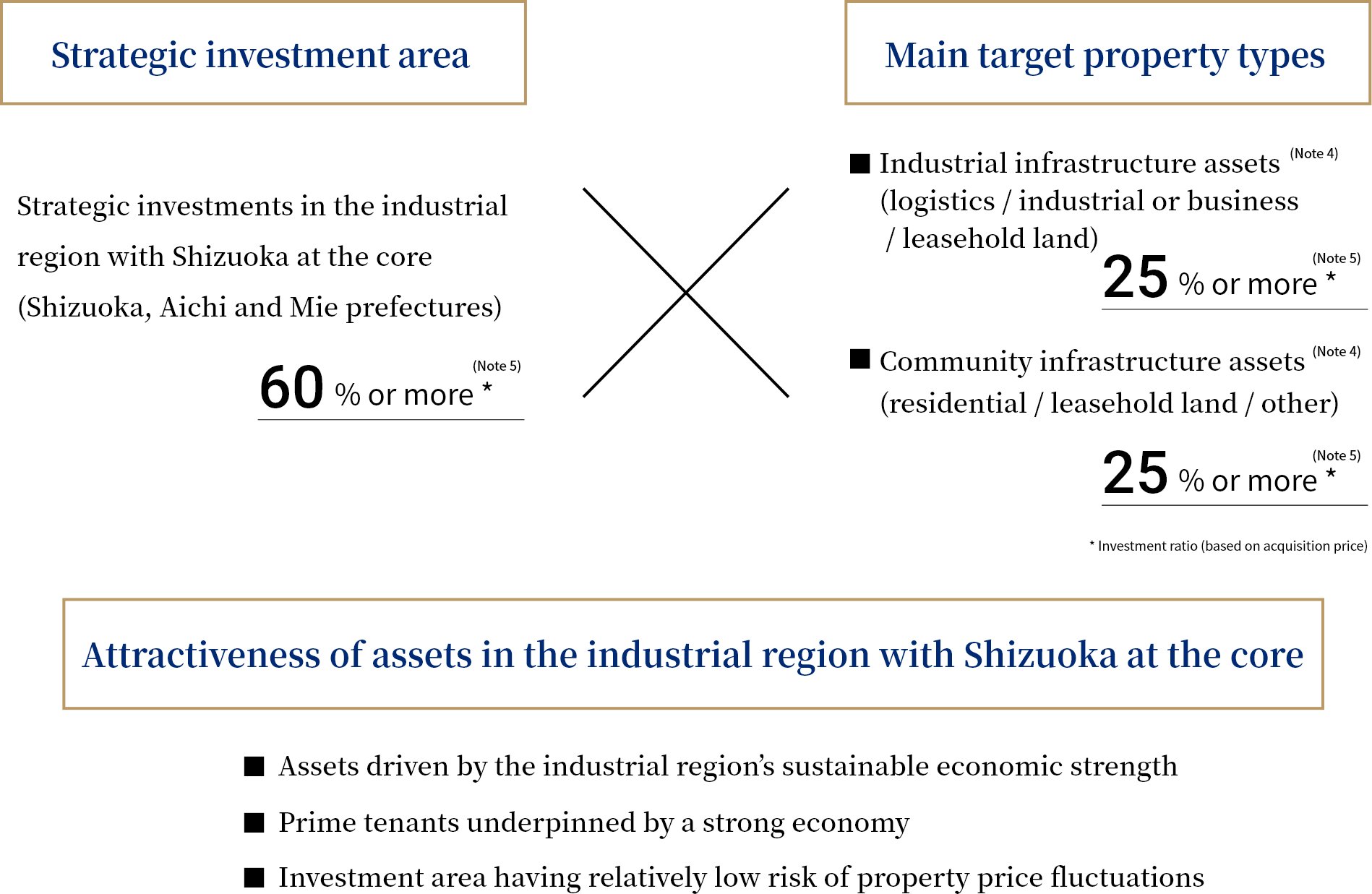

Tokaido REIT seeks to enhance unitholder value while contributing to the regional economies’ further revitalization and industrial development by investing mainly in the Tokaido region, which connects Japan’s eastern and western hubs and boasts the world’s third-largest economy (GDP), based on our strategy to invest in the industrial region with Shizuoka at the core (Note 2) (Shizuoka, Aichi and Mie prefectures), as well as in the Tokaido vicinity (Note 3).

- “Tokaido region” refers to Shizuoka, Aichi, Mie, Tokyo, Kanagawa, Gifu, Shiga, Kyoto, and Osaka prefectures.

- As Yoshicon Co., Ltd., the main sponsor of Tokaido REIT, is based in Shizuoka Prefecture and Tokaido REIT also places particular focus on Shizuoka Prefecture in its investment, “industrial region with Shizuoka at the core” is used as a term collectively referring to Shizuoka, Aichi and Mie prefectures.

“Industrial region with Shizuoka at the core” is a term originated by Tokaido REIT that collectively refers to Shizuoka, Aichi and Mie prefectures given that Yoshicon Co., Ltd. (the main sponsor of Tokaido REIT) is based in Shizuoka Prefecture and Tokaido REIT also places particular focus on assets in Shizuoka Prefecture. - “Tokaido vicinity” refers to the Tokaido region’s neighboring Chiba, Saitama, Yamanashi, Nagano, Hyogo, Nara and Wakayama Prefectures.

- “Industrial infrastructure assets” refers to logistics facilities and facilities utilized by companies for industrial or business purposes, and leasehold land used for such facilities.“Community infrastructure assets” refers to residential properties and leasehold land of such, and leasehold land and other assets used for distribution or sale of daily necessities.

- The ratios above are merely rough guides and not a guarantee that Tokaido REIT’s asset mix will actually add up to the ratio shown above.Circumstances whilst building up the portfolio and other activities may cause a temporary divergence from the ratios above.

Investment Highlights

A J-REIT investing in stable assets in the Tokaido region, which connects Japan’s eastern and western hubs

- Strategic investments in the “Industrial Region” that has a sustainable economic base

- Growth based on a stable portfolio backed by industrial and population clusters

- Support that draws on the extensive insight of sponsors rooted in the “Industrial Region”

- Pipeline development driven by CRE proposals

- Stable financial base backed by a strong lender formation